The Nigeria Social Insurance Trust Fund (NSITF) is a cesspool of fraud and lawlessness, a report has said

A Federal Government panel has uncovered about N62.555 billion fraud in the agency.

The money was spent without proper accounting procedures being followed, according to the panel, which submitted its report to the government yesterday.

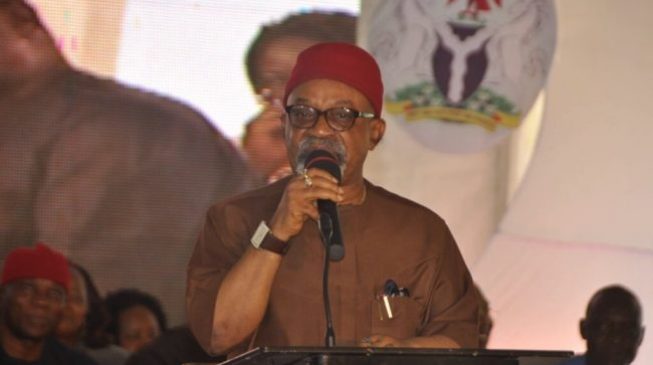

Minister of Labour and Employment Chris Ngige said any member of the staff indicted by the report will face the law.

The chairman of the Administrative Panel, Ishaya Awotu, said while presenting its final report to the minister that the Fund’s books have not been fully audited since 2011.

The panel discovered that several unauthorised allowances were paid to the staff and the management. Overseas trips and training were carried out without approval from the office of the Secretary to the Government of the Federation as required by civil service rules.

The minister had in February 2018 inaugurated the panel to investigate the finances of the Fund, following a damning report from the Economic and Financial Crimes Commission (EFCC) indicting former Board members.

Some senior management staff were sent on compulsory leave to allow the panel carry out its assignment without any interference.

Awotu said that the panel noticed weaknesses in the operation of the Fund, adding that even though it had External Auditors from 2011 to 2015, the audited financial statements and the management letters for year 2011, 2012, 2013 and 2014 were submitted to the management, but were incomplete.

He said: “As at the time of forwarding this report, none of the years audited accounts has been concluded while the audit reports remained unsigned. The basis for management’s re-appointment of the external auditors for the auditing of 2015 accounts could not be ascertained;

“The Fund does not have Financial Operational Manual to guide in its financial activities while compliance with the provisions of the Financial Regulations in carrying out their financial transactions was very weak;

“Bank reconciliation of most of the bank accounts of the Fund was not carried out. Without the reconciliation of the bank statements, irregular payments and fraud committed on the accounts cannot be detected. Furthermore, financial statements prepared from unreconciled accounts cannot be reliable. Non-reconciliation of bank accounts violates Section 716 of the Financial Regulations;

“The internal Audit function of the Fund was ineffective. The Panel observed that for the period 2013 to 2017, the internal Audit Department did not audit the cashbooks of the various bank accounts at the headquarters of the Fund; books and records of Investments and Treasury Department, Procurement Processes, Registration of Employers and payment of contributions by the Employers, Enforcement and Inspection activities, Fixed Assets etc. The lack of effective auditing of the Fund’s accounts and records violates section 1701 of the Financial Regulations;

“It was observed that the Fund was operating with incomplete books of accounts. Several bank statements of the various bank accounts, cashbooks, etc. were not submitted for audit examination and sighting. Financial statements (accounts) produced from such accounting system cannot be reliable.”

According to the report, “there were several transfers of funds in between bank accounts without authorization and approvals”. “The sum of N15,737,757,697.91 was transferred from one account to another. Evidence of the approvals and payment vouchers authorising the transfers were not presented to the Panel, it said.

Observations are that:

- N2,990,184,262.77 was expended on computerisation and other related lCT equipment without tangible result;

- Overseas tours and trainings were undertaken without the approval of the Secretary to the Government of the Federation;

- the Fund does not maintain Expenditure Vote Control Books required for the monitoring and control of the various sub-heads. None maintenance of the vote-books made it impossible for the Fund to control extra budgetary spending;

- N2,650,731,225.93 deducted from various payments in respect of Withholding Tax (VAT), Pay-As-You-Earn (PAVE), Value Added Tax, Pension and National Housing Fund were not remitted to the relevant authorities;

- N5, 744,968,834.13 “irregular allowances” were paid to staff and management.

“Some of the allowances such as Management Staff Allowance, Staff Education Allowance. DSTV Subscription Allowance, Dressing Allowance, Generator and Motor Vehicle Fueling Allowance paid to staff and management were not provided for in the Condition of Service of the Fund.

- Payment vouchers in the sum of N27,056,598,053.92 were not presented to the Panel for audit examination and sighting; and

- Payment vouchers in the sum of N8,376,083,789.72 were without adequate supporting documents

The panel recommend that the management should conclude the External Auditors’ Reports for 2011 to 2015. New external auditors should be appointed immediately to audit the accounts of 2016 and 2017 financial years.

The panel also said that NSITF should carry out full reconciliation of assets acquired and recorded in the cashbooks against the Fixed Assets Register.

“The Staff Condition of Service should be reviewed, with immediate effect, to correct lapses contained therein. There is also the need to review the investment Policy Document of the Fund,” the report said, adding:

“A professional firm of accountants should be engaged to carry out in-depth examination of transfers in-between the accounts to ensure that the transfers of N15, 37,757,697.91 were properly accounted for.

“The Firm should also carry out the bank reconciliation of the accounts of the Fund from its inception to date to assure that there are no financial losses resulting from the non-reconciliation of the accounts.”

The panel demanded to see the payment vouchers N27,056,598,053.92 that were not presented to it for audit examination and sighting;

The Fund should also produce the relevant supporting documents . for the various payment vouchers with total monetary value of N8,376,083,789.72 to substantiate the payments, the report said.

It also recommended that a financial plan on the remittance of the N2,650,731,225.93 deducted from staff salaries to various authorities should be made.

Receiving the report, Ngige promised that it would be implemented fully and the lapses identified corrected.

He said “Those findings especially about overseas trips which are unauthorised will be dealt with because they are actions that breached public service rules. It is not true that parastatals are exempted from public service rules. This report will be fully implemented and areas of lapses corrected. So many government organisations have gone under because of situations like this.”

He went on: “Following the whistle blowing policy of this administration, the EFCC moved into the place and did some forensic auditing of the accounts of the agency.

“After reading the EFCC report, we felt it was necessary to set up this administrative panel to find out why the internal audit mechanism broke down in such a way that the N62 billion contributed cannot be seen.

“Those indicted included those nominated by the Nigeria Labour Congress and the Nigeria Employers Consultative Association. So, we were not in a hurry because we needed to give the new board a new lease of life because you don’t put new wine in old wine skin.” - The Nation